Together,

let’s find the way up!

We are a Czech financial group

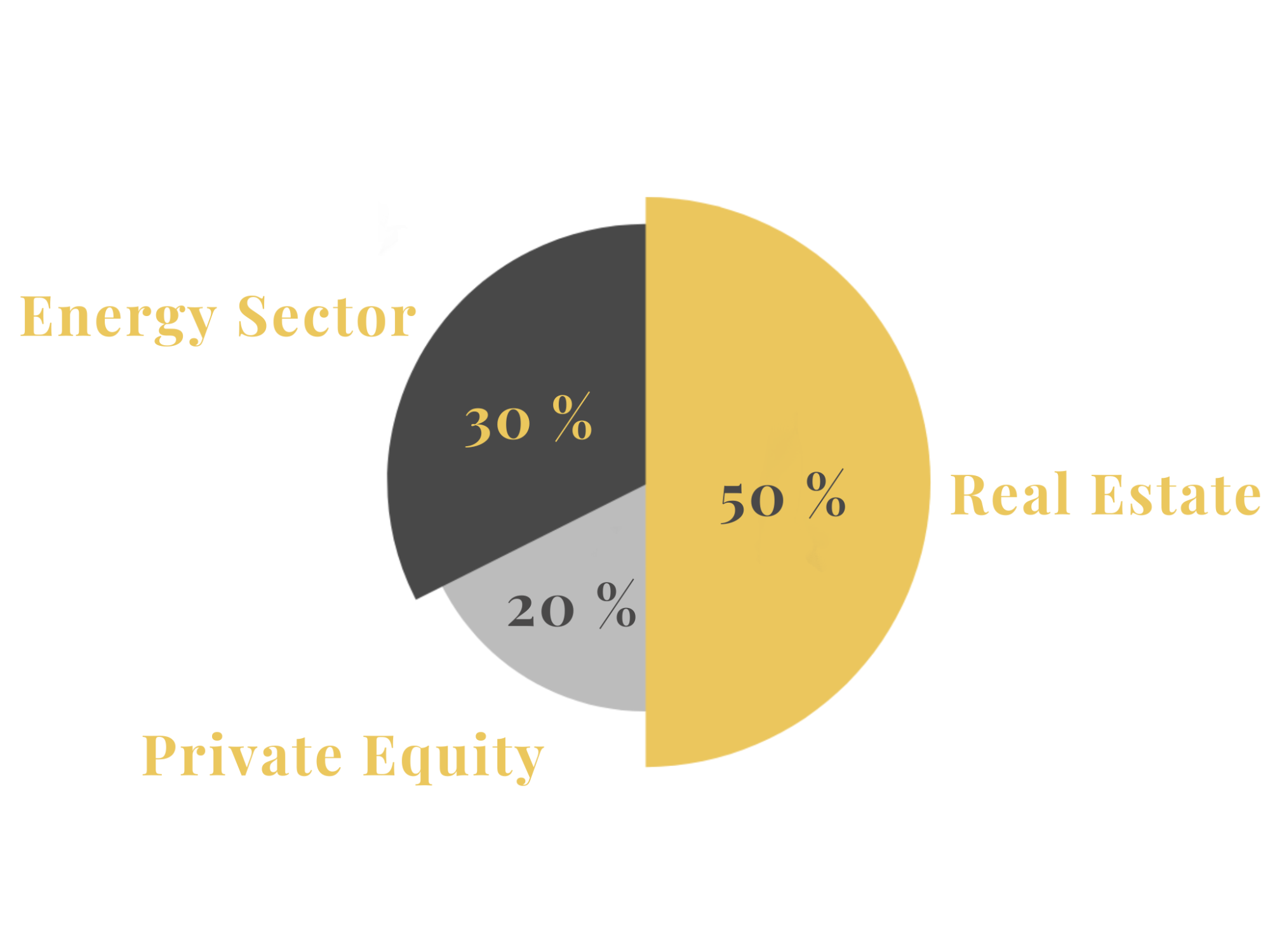

Our philosophy is long-term appreciation of our own and entrusted capital through gradual growth. In particular, we focus on three key areas of activity. These are the real estate business, the sustainable energy industry and technology start-ups.

Filip Navrátil founded the company in 2016 and gradually brought together a team of professionals with many years of experience in the industry.